City of Austin

FOR IMMEDIATE RELEASERelease Date: Feb. 05, 2026

Contact: Tamarind Phinisee 5129742271 Email

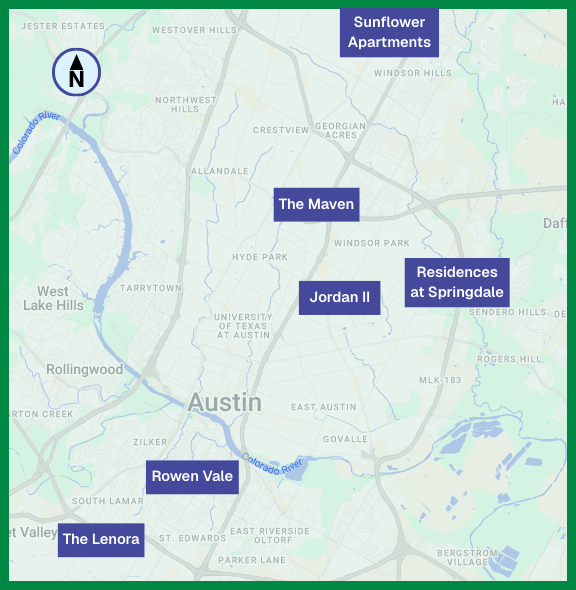

Proposed developments will bring over 400 new units across 5 districts

AUSTIN, TX – Austin Housing is pleased to announce that six local affordable housing developments have received resolutions of support from the Austin City Council to apply for 9% Low-Income Housing Tax Credits (LIHTC) from the State of Texas.

Getting these resolutions is the first step developers must take before they can formally apply to the state agency which administers the program, the Texas Department of Housing and Community Affairs (TDHCA), and compete in this annual process.

“The availability of affordable housing is essential to Austin’s ability to remain an inclusive and thriving community,” said Deletta Dean, Director of Austin Housing. “These resolutions are a key step in the process, allowing developments to compete for critical funding that can turn proposed projects into long-term, affordable homes for Austin residents.”

Typically, the competitive process begins in January and awards are made by the TDHCA in July. To be eligible for the 9% LIHTC, developers are required to obtain a supportive resolution from the City Council as part of their application. City Council resolutions are submitted with each development’s tax credit application to the TDHCA, and the TDHCA will determine which proposed developments will receive an award of LIHTC funding.

Projects that receive this award must meet eligibility for at least 30 years after project completion, with awarded projects typically electing to provide 45 years of affordability, keeping rental units rent-restricted and available to low-income tenants. Once this period ends, the properties remain under the control of the owner.

“The 9% LIHTC program is highly competitive and a critical tool to finance deeply affordable housing,” said Brendan Kennedy, Division Manager for Austin Housing. “Council support signals that these projects align with Austin’s housing goals and are ready to advance through the state review process.”

Resolutions of support

The six developments that received a resolution of support are as follows:

Rowen Vale

Rowen Vale, located in District 9 at 206 E. Annie St. Plans call for the construction of 75 affordable multifamily housing units. O-SDA Industries will be the developer. The property is located within half a mile walking distance of the Austin Light Rail Phase 1 alignment and in a High Opportunity Area (an area where people would most likely succeed because of access to employment, high performing schools, fresh and healthy foods, etc.) as shown in the RHDA/OHDA program Opportunity Map series.

- 8 units will be available for rent to households earning at or below 30% MFI,

- 29 units will be available for rent to households earning at or below 50% MFI,

- 34 units will be available for rent at 60% MFI, and

- 4 units will be available for rent at 80% MFI

The Lenora

The Lenora, located in District 5 at 4507 Menchaca Road. Plans call for the development of a 39-unit multifamily community. The property is located within half a mile walking distance of high-frequency transit and in a High Opportunity Area. O-SDA Industries will be the developer. The proposed development will have a 45-year affordability period.

- 4 units will be available for rent at or below 30% MFI,

- 18 units will be available for rent at or below 50% MFI,

- 14 units will be available for rent at or below 60% MFI, and

- 3 units will be available for rent at or below 80% MFI

The Maven

The Maven, located in District 4 at the northwest corner of E. Highland Mall Dr. and Middle Fiskville Road. Plans call for the construction of an 80-unit affordable multifamily community. The property will include one and two-bedroom units, some of which will be accessible for residents with mobility and sensory impairments. The developer will be Austin Highland DMA Housing LLC.

- 7 units will be available for rent at or below 30% MFI,

- 28 units will be available for rent at or below 50% MFI,

- 35 units will be available for rent at or below 60% MFI, and

- 10 units will be available with no income restrictions

Residences at Springdale

Residences at Springdale, located in District 1 at 5612 Springdale Road. Plans call for the construction of a 70-unit affordable multifamily development. The proposed community will include a mix of one-, two- and three-bedroom units. The developer will be Residences @ Springdale LP.

- 7 units will be available for rent at or below 30% MFI,

- 28 units will be available for rent at or below 50% MFI, and

- 35 units will be available for rent at or below 60% MFI

Jordan II

Jordan II, located in District 9 at 2701 ½ Philomena St. Plans call for the construction of a 80-unit affordable multifamily development. The proposed community will include a mix of one-, two- and three-bedroom units and have a 40-year affordability period. The developer will be Jordan Housing II, LP. The property is located within half a mile walking distance of two Project Connect-funded CapMetro Rapid bus lines, routes 800 and 837.

- 16 units will be available for rent at or below 30% MFI, and

- 64 units will be available for rent at or below 50% MFI

Sunflower Apartments

Sunflower Apartments, located in District 4 at 601 W. Braker Ln. Plans call for the construction of an 80-unit affordable multifamily development. The proposed community will include a mix of one-, two- and three-bedroom units and have a 40-year affordability period. Foundation Communities plans to enter into a 99-year ground lease with United Methodist Church for the development. The developer will be FC St. Marks Housing LP.

- 16 units will be available for rent at or below 30% MFI,

- 28 units will be available for rent at or below 50% MFI, and

- 35 units will be available for rent at or below 60% MFI

Program Overview

The Low-Income Housing Tax Credit (LIHTC) program is a federal initiative created by the Tax Reform Act of 1986 to incentivize the development and preservation of affordable rental housing. Administered by the Internal Revenue Service (IRS), the program allocates tax credit authority (approximately $10.2 billion in annual budget authority …) down to state housing finance agencies for distribution.

Through the Texas Department of Housing and Community Affairs (TDHCA) housing developers may receive a dollar-for-dollar federal tax credit to offset up to either 4 percent or 9 percent of its federal tax liability in exchange for building or rehabilitating low-income rental housing. The 9 percent tax credit is awarded through a competitive process. These credits typically subsidize 70 percent of the unit costs and support new construction without the use of additional federal subsidies.

Developers applying for the 9% tax credits must meet a series of criteria that are set by both the city and the state.

TDHCA awards tax credits based on regional scoring. The state is divided into 11 regions; Austin is located in Region 7, which includes Travis County and surrounding counties. Region 7 is expected to receive up to $7,164,653 in funding in 2026, which may be sufficient to provide funding for three to four developments in the Region. Additional information can be found in the Austin Housing Memo.

"In addition to to creating new housing, these developments commit to long-term affordability—often well beyond the minimum requirements,” Kennedy said. “That means rent-restricted homes that remain available to low-income households for decades, helping ensure stability for families and individuals throughout Austin.”

###

About Austin Housing

Austin Housing creates and preserves housing opportunities to stabilize communities. To access affordable housing and community resources that help you, visit www.austintexas.gov/housing.

About the Austin Housing Finance Corporation

The Austin Housing Finance Corporation (AHFC) was created as a public, non-profit corporation and instrumentality of the City of Austin. The mission of the AHFC is to generate and implement strategic housing solutions for the benefit of low- and moderate-income residents of the City of Austin.